Analysts do not agree on the company founded and directed by Elon Musk. Some see good value potential, while others recommend running away as soon as possible.

Tesla is driving Wall Street crazy. The manufacturer of electric cars is so unique that analysts do not find a consensus on what the real situation of the company is, as they show the disparity in the purchase recommendations or the huge difference in the objective prices of experts.

The titles of the signature of Fremont are already in the surroundings of the $ 430 after an advance of more than two percentage points in the session of this Thursday in Wall Street. Thus, while stalking its historical highs, the creature of Elon Musk already has a capitalization that is close to $ 80,000 million.

Despite this, schizophrenia is evident. While Gordon Johnson, an analyst at GLJ Research, believes Tesla’s shares are really worth $ 44, colleague Pierre Ferragu, who works for New Street Research, says they should be priced at $ 530. How is it possible that there is such a difference?

In total, there are 36 signatures of analysis covering Tesla. Of these, 11 recommend their customers to buy shares, 10 choose to wait for events and the remaining 15 believe that it is best to fold candles, collect benefits and look for greener pastures. Again, division.

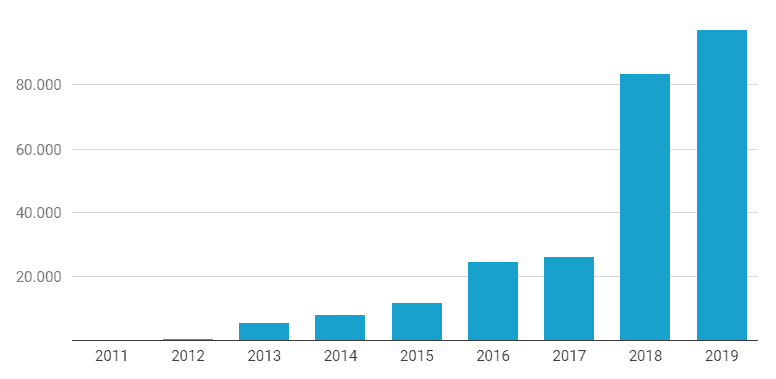

During the year 2019, Tesla has won 26% in the stock market and is very close to the highest levels in its history. It has done so with a record of vehicle delivery and the highest turnover in its history, achieving profitability – still unbound – along the way. All this has not served to put the market on its side, reluctant to obviate the 14,500 million dollars, almost 13,000 million euros, which appear on the balance sheet accompanied by the word ‘debt’.

That imposing liability does not scare Jed Dorsheimer, an analyst at Camaccord, who has just raised his Tesla target price from $ 375 to $ 515 per title. For Dorsheimer, “the market has always feared Tesla’s demand problems”, but believes that “the fourth quarter of its fiscal year will be solid” and that it will be combined “with a third-quarter that was already robust”. He also points out that vehicle deliveries for 2019 are above estimates.

In the same line is JMP Securities, which considers that “this year’s delivery consensus is well below reality”. They assure from the Californian firm that these previous metrics “do not reflect the contribution of the Shanghai factory, which is already underway”. These judgments are very similar to those issued by Wedbush, which in a letter sent to its customers last December pointed to Tesla’s positive trend in Europe and China.

Of course, Wall Street also harbours a handful of unbelievers in the actions of Elon Musk. Jeffrey Osborne, an analyst at New York City Cowen, believes that “beyond China and the Netherlands, Model 3 deliveries will be very low“. Bradford Meikle of Williams Research also sees more shadows than lights and has placed a target price of $ 70 on Tesla, barely a quarter of the current value.

Inflexion point

Tesla is very close to testing the polarization of analysts. The company faces a fiscal year-end closing in which there are only two paths: ‘boom or bust’. Either the numbers of delivered cars exceed Musk’s promises and the market receives the news with joy or stays below estimates and investors flee in terror. With Tesla, there is no middle ground.

In the company, they have closed the year with their tongue out. Musk himself asked for volunteers on his staff to bring keys to the hands of the buyers of his vehicles. The objective must be met and for that, it will be necessary to put 105,000 more cars on the street, which would be the highest figure in the history of the firm.

Among other things, Musk has received good news from the Netherlands and China. The European country – formerly known as the Netherlands – is experiencing a true fever and only in December 11,563 Model 3 were enrolled, according to Bloomberg data. The reason for the euphoria? On January 1, the tax incentives that come with the purchase of a clean vehicle are finished and the Dutch – formerly known as Dutch – have taken advantage of the discount to save a few euros.

As for the Asian giant, the world’s first market, the good news comes from Shanghai. The Tesla factory, still smelling new, is already taking cars to its new owners. It is very important for Tesla that this plant operates at full capacity as soon as possible since it represents a significant saving in shipping and relief of Trump and Xi Jinping tariffs.

As if that were not enough, the market is fighting to buy Tesla debt. The one-year default risk is at a minimum and, according to Joel Levington, a Bloomberg analyst, “the credit profile for 2020 shows improvements, with an upward EBITDA”.