The digital development of luxury goods is the new “holy grail” and the famous luxury goods companies are joining the online markets to face Amazon

Richemont may be unknown to the general public but its properties are well known: One of them is the Cartier luxury goods house. It also owns the online retail store Yoox Net-a-Porter (YNAP).

YNAP will partner with its most key competitor in the fast-growing online market: the UK retail platform Farfetch.

Richemont and Chinese Alibaba Group Holding will buy Farfetch convertible bonds worth $ 300 million each. Richemont will thus be able to participate in Farfetch.

These moves are obviously good news for Farfetch, which is acquiring two powerful new investors in addition to its long-term partner Tencent Holdings. However, Richemont, which owns Cartier, will also benefit from them.

In addition, Johann Rupert, president of Richemont, said that there would be further cooperation between YNAP and Farfetch in the future. Their collaboration would be the news of the year especially if it resulted in the sale of YNAP by Richemont. Although investing in online shopping is a strategic choice, the group’s online businesses and especially YNAP are not doing well and are loss-making.

Both YNAP and Farfetch are online retailers of luxury goods, but they operate differently. YNAP is like a traditional department store: It buys goods and keeps them until it sells them to customers. At Farfetch, the majority of sales are for boutique accounts, which pay a commission for everything sold.

The combination of both approaches would create a strong platform that would dominate the online sales of luxury goods. A platform of this scale could overcome the difficulties faced by online retail. In addition, it could act as a bulwark against Amazon, which has now targeted luxury goods.

And it’s not just Richemont. Artemis, the investment vehicle of the Pinault family, which is Gucci’s largest shareholder and owner of Kering, will also increase its investment in Farfetch, with a $ 50 million stake. Richemont and Kering are already working together in the optics industry.

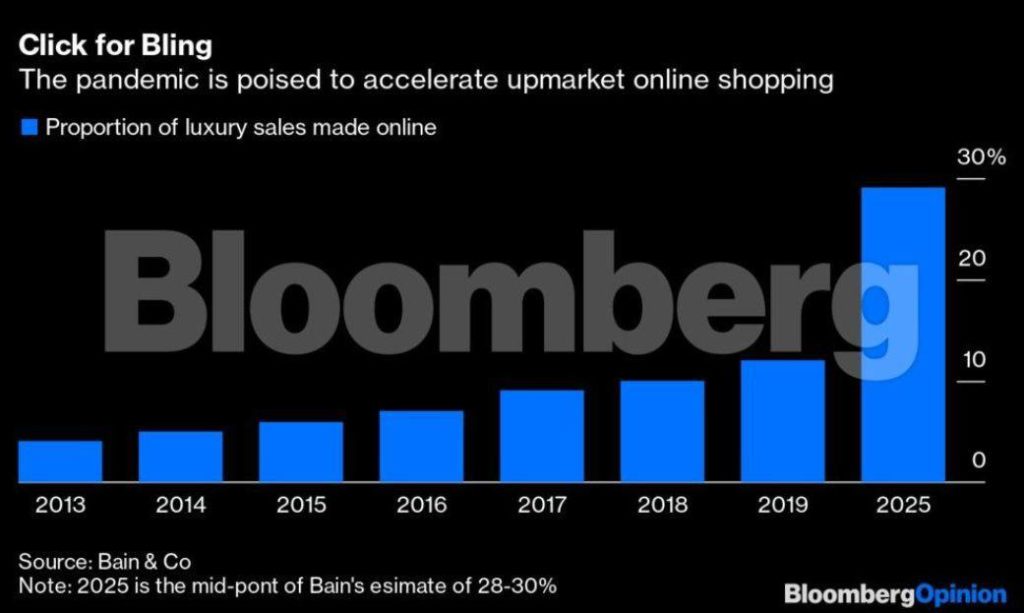

The chart below very eloquently illustrates the reasons why large luxury goods companies have now put the growth of their online sales on their agenda as they are expected to have tripled by 2025, receiving an additional boost from this year’s pandemic.