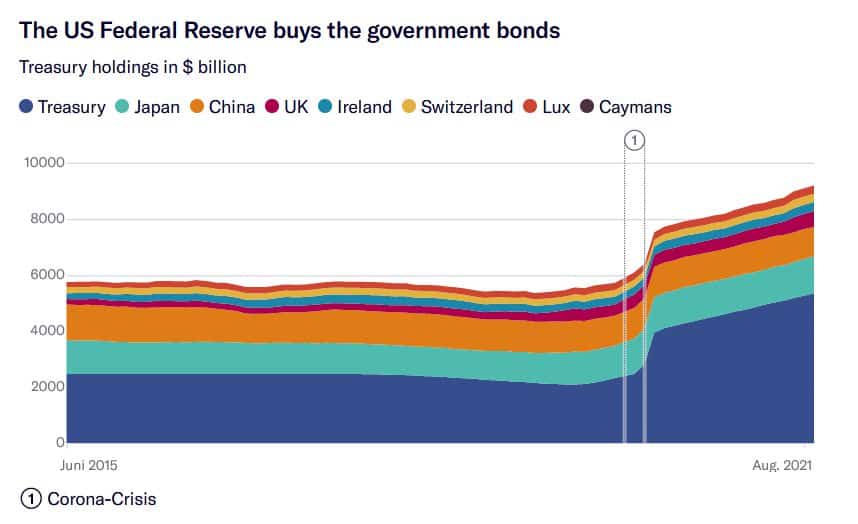

Since the central bank hinted at reducing bond purchases, liquidity has decreased and yield volatility has risen. Some observers believe the Fed will never truly be able to exit the market, owing to decreasing international interest.

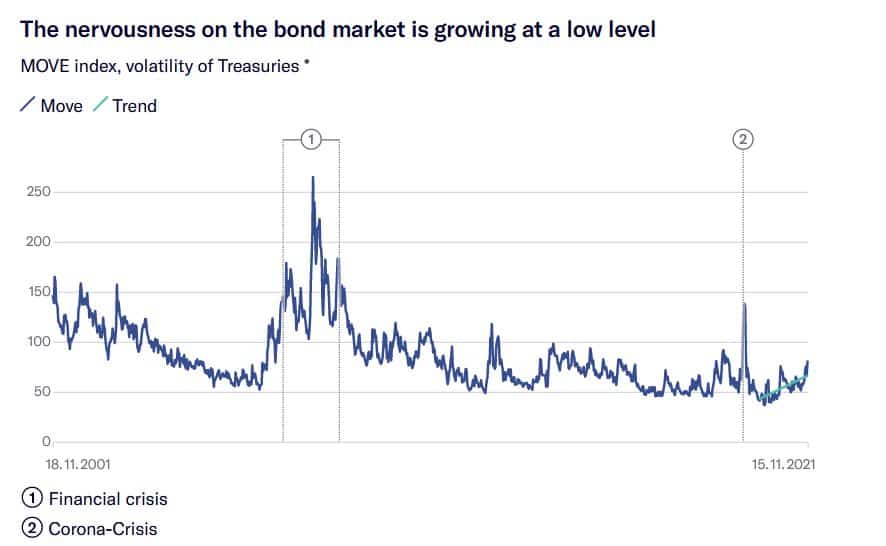

For two reasons, the US government bond market appears to be jittery. For starters, many strategists believe that the US Federal Reserve has made a mistake and will soon be obliged to not only take its foot off the acceleration pedal, but also to stop properly, due to massive price inflation. Experts such as Mohamed El-Erian, the former chief strategist of Allianz, and Bill Dudley, the former President of the Federal Reserve Bank of New York, believe that the Fed will be forced to act, resulting in more volatility in the price development of assets such as bonds, equities, and currencies.

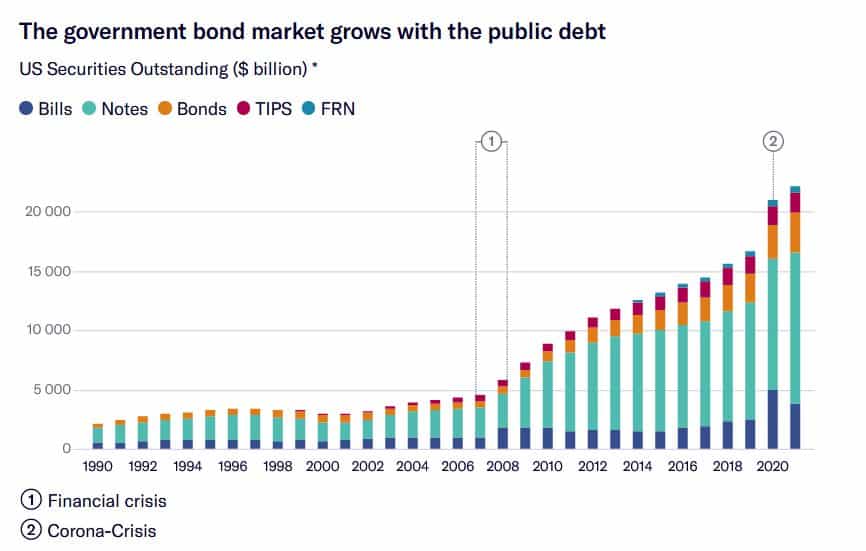

Second, structural issues have emerged since the Fed announced that it will gradually reduce the huge asset purchases made in recent months, eventually ending them entirely, and then possibly raising the key interest rate. Meanwhile, individuals who want this process to move faster are becoming more vocal, which can lead to practical challenges. On the one hand, trading in US government bonds is often regarded as the most important and liquid section of the international financial markets, because it is where interest rates are practically earned when pricing assets worth $ 50,000 billion globally.

In recent weeks, however, there have been notable price changes in very small transactions. For example, Bank of America analysts Mark Cabana, Ralph Axel, and Meghan Swiber report that in the trading of inflation-protected government securities, they have seen big price movements with extremely modest volumes. The futures market for short-term government bonds has “collapsed liquidity,” according to Jefferies analysts, and the consequence of the recent auction of 30-year government bonds was “catastrophic.” This makes them jittery. Finally, Treasuries are utilized not only to refinance the US government’s spending, but also to manage interest rate risks and serve as a risk-free benchmark for the pricing of other financial instruments.

Essentially, the entire financial world believes that it can purchase or sell US government bonds at any time at a reasonable price. If this is no longer the case, domino consequences could occur as associated segments such as the mortgage markets become illiquid and unable to withstand external shocks.

The phenomenon appears almost exactly seven years after a 12-minute “flash rally” in which the yield on ten-year US government bonds fell and then recovered, seemingly without any evident cause. Not only should this not happen in the world’s largest government bond market, with a notional value of $ 22,000 billion, but the urgency may even increase. After all, the Fed’s enormous interventions in recent years have nearly brought government bonds to a halt, and now the central bank plans to reduce monthly purchases by $ 10 billion.

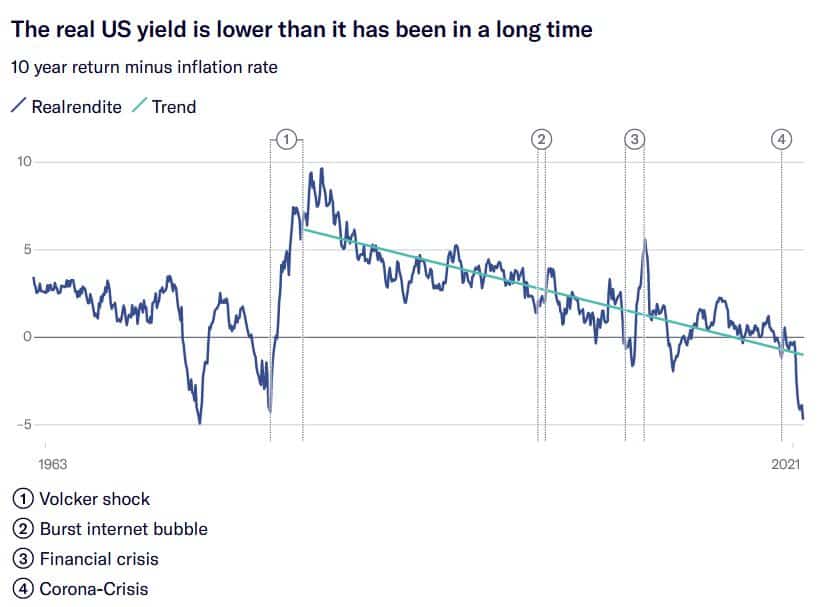

The volatility in currency rates and treasury market returns also reflect the general uncertainty about the economy’s and monetary policy’s evolution, which is exacerbated by growing prices, a labor shortage, and incredibly poor returns. After accounting for the high inflation rate of 6.2 percent, an American government bond with a duration of about ten years now yields a real return of –4.6 percent. Everyone expected the market to calm down after Federal Reserve Chairman Jerome Powell recently stated that he was not in a hurry to hike interest rates.

The practical test for American monetary and fiscal policy, indirectly for the central bank, and most likely also for investors, has only just begun, according to Robin Brooks. The top economist of the Washington Institute of International Finance (IIF) is adamant that the massive fiscal stimulus has long since returned the US economy to its pre-crisis trajectory – something that failed to happen after the financial crisis. Fed President Jerome Powell, in his opinion, overestimates the extent of American unemployment since the stimulus packages would have weakened the link between still-low employment and massive consumer spending.

In the face of low returns and a strong currency, investors appear to have accepted the de facto monetization of massive budget deficits, notwithstanding troubling treasury market events. According to Brooks, foreign investor demand in US Treasuries has been so high for so long that yields have remained remarkably low during the Greenspan era. But, after a noticeable drop in demand in the wake of the Covid debacle, the Fed was forced to buy government bonds worth $ 1,500 billion in 2020 in order to keep the market from collapsing after a sell-off in March of that year.

Weak liquidity inflows from overseas into the American treasury market, according to the IIF report, constitute a fundamental change that cannot be corrected simply by “manual interventions” in the market’s functionality. In the backdrop, however, there are two essential questions. First, was the fiscal stimulus excessive, and is inflation in the United States on the verge of ballooning out of control? Second, what are the medium-term ramifications of the Covid debt being monetized? While the answers are still unknown for the time being, it is clear that a number of hedge firms have burned their fingers in recent weeks by taking risky bets on dropping yields. If they’ve learned anything from this, they’ll be more cautious in the future, which isn’t going to assist the market’s liquidity supply.

Image Credit: iStock

You were reading: US Treasuries – nervousness is growing in the world’s largest bond market